P = [3.5000 1.1100 1.1100 1.0400 1.0100;

0.5000 0.9700 0.9800 1.0500 1.0100;

0.5000 0.9900 0.9900 0.9900 1.0100;

0.5000 1.0500 1.0600 0.9900 1.0100;

0.5000 1.1600 0.9900 1.0700 1.0100;

0.5000 0.9900 0.9900 1.0600 1.0100;

0.5000 0.9200 1.0800 0.9900 1.0100;

0.5000 1.1300 1.1000 0.9900 1.0100;

0.5000 0.9300 0.9500 1.0400 1.0100;

3.5000 0.9900 0.9700 0.9800 1.0100];

[m,n] = size(P);

Pi = ones(m,1)/m;

x_unif = ones(n,1)/n;

cvx_begin

variable x_opt(n)

maximize sum(Pi.*log(P*x_opt))

sum(x_opt) == 1

x_opt >= 0

cvx_end

R_opt = sum(Pi.*log(P*x_opt));

R_unif = sum(Pi.*log(P*x_unif));

display('The long term growth rate of the log-optimal strategy is: ');

disp(R_opt);

display('The long term growth rate of the uniform strategy is: ');

disp(R_unif);

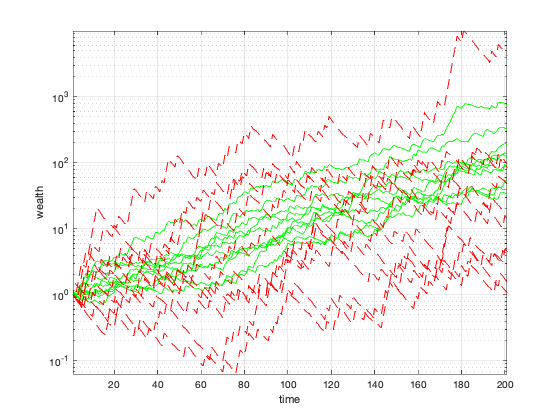

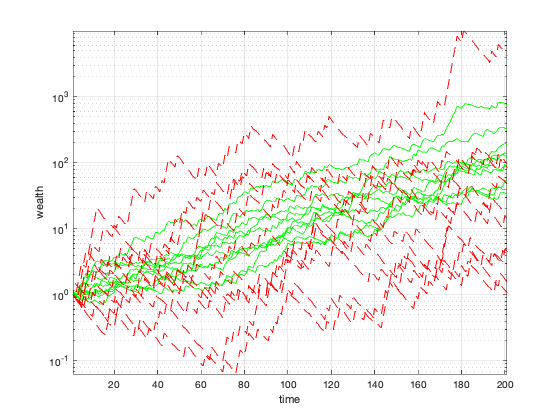

rand('state',10);

N = 10;

T = 200;

w_opt = []; w_unif = [];

for i = 1:N

events = ceil(rand(1,T)*m);

P_event = P(events,:);

w_opt = [w_opt [1; cumprod(P_event*x_opt)]];

w_unif = [w_unif [1; cumprod(P_event*x_unif)]];

end

figure

semilogy(w_opt,'g')

hold on

semilogy(w_unif,'r--')

grid

axis tight

xlabel('time')

ylabel('wealth')

Calling Mosek 9.1.9: 36 variables, 15 equality constraints

For improved efficiency, Mosek is solving the dual problem.

------------------------------------------------------------

MOSEK Version 9.1.9 (Build date: 2019-11-21 11:32:15)

Copyright (c) MOSEK ApS, Denmark. WWW: mosek.com

Platform: MACOSX/64-X86

Problem

Name :

Objective sense : min

Type : CONIC (conic optimization problem)

Constraints : 15

Cones : 10

Scalar variables : 36

Matrix variables : 0

Integer variables : 0

Optimizer started.

Presolve started.

Linear dependency checker started.

Linear dependency checker terminated.

Eliminator started.

Freed constraints in eliminator : 1

Eliminator terminated.

Eliminator - tries : 1 time : 0.00

Lin. dep. - tries : 1 time : 0.00

Lin. dep. - number : 0

Presolve terminated. Time: 0.00

Problem

Name :

Objective sense : min

Type : CONIC (conic optimization problem)

Constraints : 15

Cones : 10

Scalar variables : 36

Matrix variables : 0

Integer variables : 0

Optimizer - threads : 8

Optimizer - solved problem : the primal

Optimizer - Constraints : 4

Optimizer - Cones : 10

Optimizer - Scalar variables : 35 conic : 30

Optimizer - Semi-definite variables: 0 scalarized : 0

Factor - setup time : 0.00 dense det. time : 0.00

Factor - ML order time : 0.00 GP order time : 0.00

Factor - nonzeros before factor : 10 after factor : 10

Factor - dense dim. : 0 flops : 4.58e+02

ITE PFEAS DFEAS GFEAS PRSTATUS POBJ DOBJ MU TIME

0 1.0e+00 1.1e+00 1.5e+01 0.00e+00 1.350234740e+01 -8.051020016e-01 1.0e+00 0.00

1 1.9e-01 2.1e-01 9.3e-01 6.72e-01 1.712662212e+00 -1.181631184e+00 1.9e-01 0.01

2 4.7e-02 5.2e-02 1.1e-01 2.36e+00 2.856263594e-01 -9.752726878e-02 4.7e-02 0.01

3 6.3e-03 7.0e-03 5.2e-03 1.18e+00 5.192195689e-02 4.471645465e-03 6.3e-03 0.01

4 2.6e-04 2.9e-04 4.2e-05 1.03e+00 2.411322106e-02 2.216544110e-02 2.6e-04 0.01

5 2.1e-05 2.3e-05 9.4e-07 1.00e+00 2.315827542e-02 2.300255456e-02 2.1e-05 0.01

6 1.5e-06 1.6e-06 1.8e-08 1.00e+00 2.308374137e-02 2.307274665e-02 1.5e-06 0.01

7 1.6e-07 1.8e-07 6.3e-10 1.00e+00 2.307890232e-02 2.307770840e-02 1.6e-07 0.01

8 1.7e-08 1.9e-08 2.2e-11 1.00e+00 2.307838501e-02 2.307825640e-02 1.7e-08 0.01

9 6.8e-09 7.6e-09 5.1e-12 1.13e+00 2.307834382e-02 2.307829450e-02 7.1e-09 0.01

10 4.7e-09 3.2e-09 1.3e-12 1.11e+00 2.307832859e-02 2.307830820e-02 3.3e-09 0.01

11 6.9e-09 1.7e-09 5.0e-13 9.89e-01 2.307832350e-02 2.307831275e-02 1.9e-09 0.01

Optimizer terminated. Time: 0.02

Interior-point solution summary

Problem status : PRIMAL_AND_DUAL_FEASIBLE

Solution status : OPTIMAL

Primal. obj: 2.3078323495e-02 nrm: 1e+00 Viol. con: 2e-09 var: 4e-10 cones: 0e+00

Dual. obj: 2.3078312755e-02 nrm: 1e+00 Viol. con: 0e+00 var: 7e-10 cones: 0e+00

Optimizer summary

Optimizer - time: 0.02

Interior-point - iterations : 11 time: 0.01

Basis identification - time: 0.00

Primal - iterations : 0 time: 0.00

Dual - iterations : 0 time: 0.00

Clean primal - iterations : 0 time: 0.00

Clean dual - iterations : 0 time: 0.00

Simplex - time: 0.00

Primal simplex - iterations : 0 time: 0.00

Dual simplex - iterations : 0 time: 0.00

Mixed integer - relaxations: 0 time: 0.00

------------------------------------------------------------

Status: Solved

Optimal value (cvx_optval): +0.0230783

The long term growth rate of the log-optimal strategy is:

0.0231

The long term growth rate of the uniform strategy is:

0.0114